PROJECT OVERVIEW

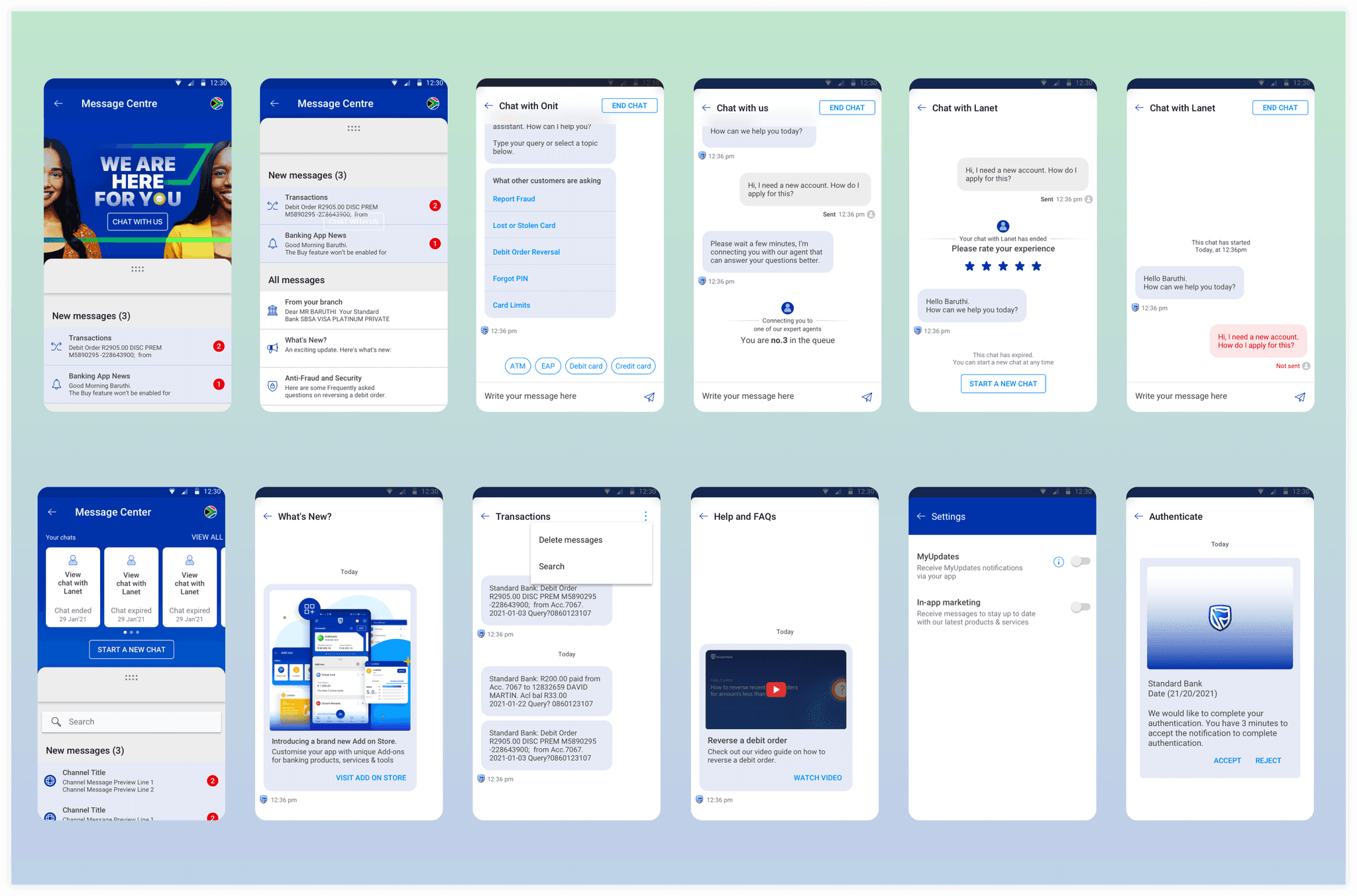

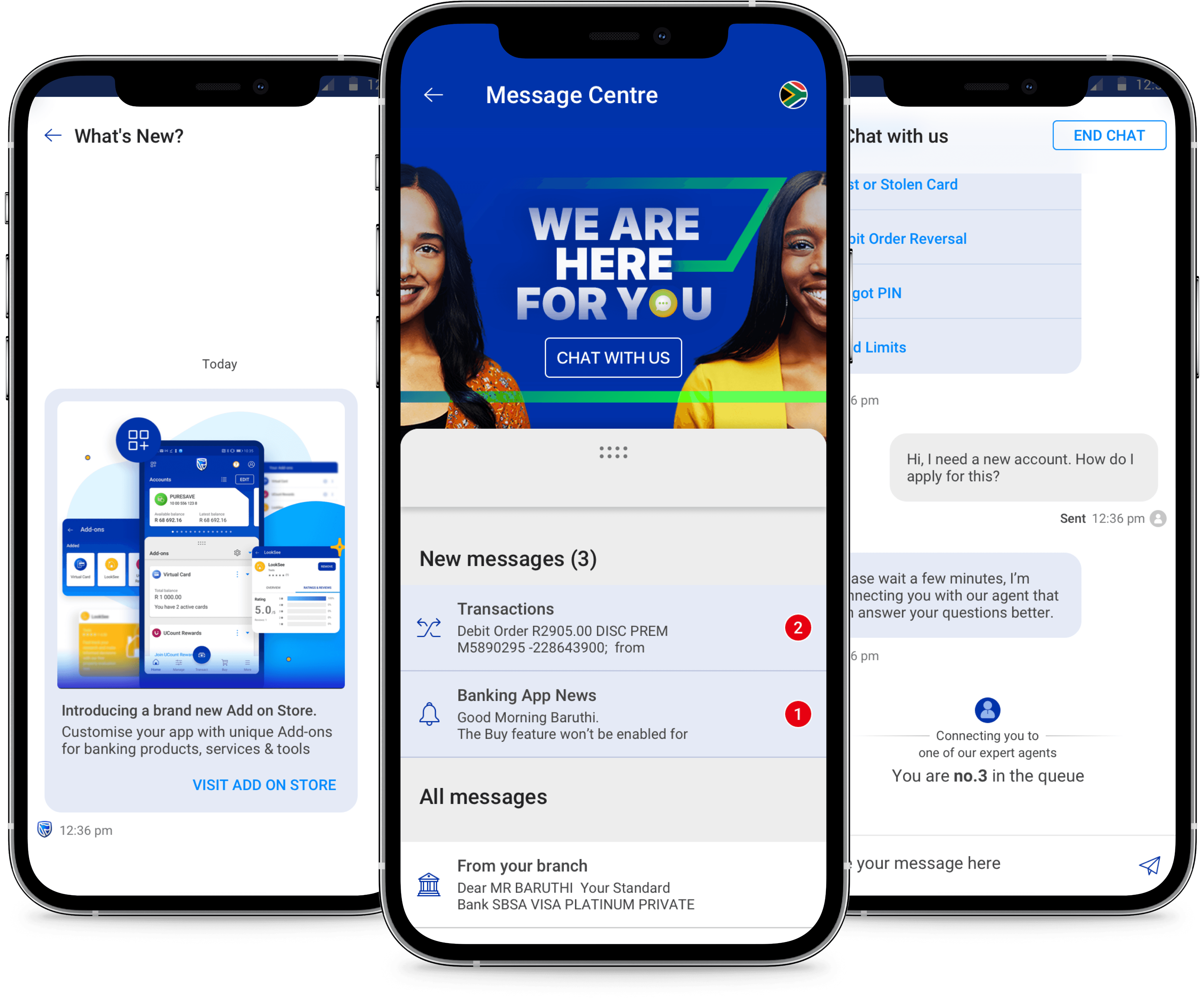

To improve our customers' digital experience and increase digital engagement, while also aiming to cut down on the bank's expenses on SMS and email messaging, we developed an In-App Message Centre along with a staff console for sending out messages. This system ensured that our customers received personalized, timely, and relevant communications, contributing to a more seamless digital banking journey.

The project was successfully rolled out to our entire customer base in early 2022, signifying a key advancement in our approach to digital banking.

Duration:

2021 - Ongoing

Role:

Design Lead (Standard Bank)

Location:

Johannesburg | Remote from India

Team Composition:

Product Manager, Design Head, Design Lead, Backend Developers, Frontend Developers, Feature Analyst, Testers

Other team collaboration:

Voice branch, AI team, Marketing team, Design system team, Copywriters

Deliverables:

Finished designs for dev, visual language for message creatives, support for AI chatbot integration

CHALLANGE

How do we develop a UI that seamlessly integrates inbox and chat messages, supports multiple media formats, and incorporates an AI chatbot?

BUSINESS GOALS

The project was driven by the need to foster deeper digital engagement and provide synergistic value to the bank and its customers through effective, personalized communication. The main goals were

Reduce

Messaging Costs

Increase

Customer engagement

Generate

More Revenue

ROADMAP

Initial Launch:

Deploying message centre and staff console for foundational communication infrastructure.

Digital Transition:

Move the entire user base from SMS and emails to the Message Centre.

Integrate AI chatbot assistant for customer support

Engagement Enhancement:

Send personalised offers and promotions

Continuous improvement of chatbot responses

MY ROLE

Strategising & developing UI for message centre and staff console.

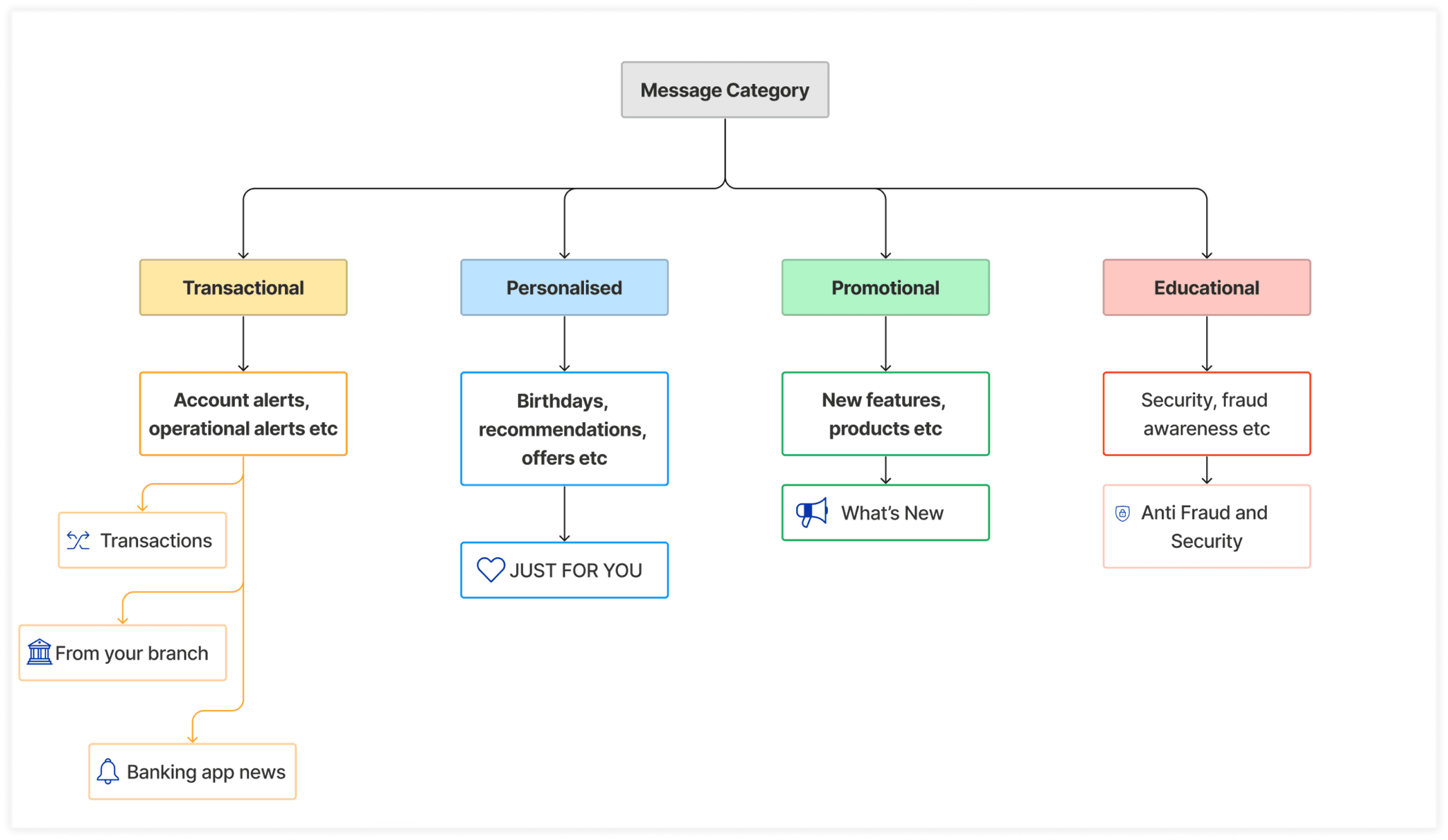

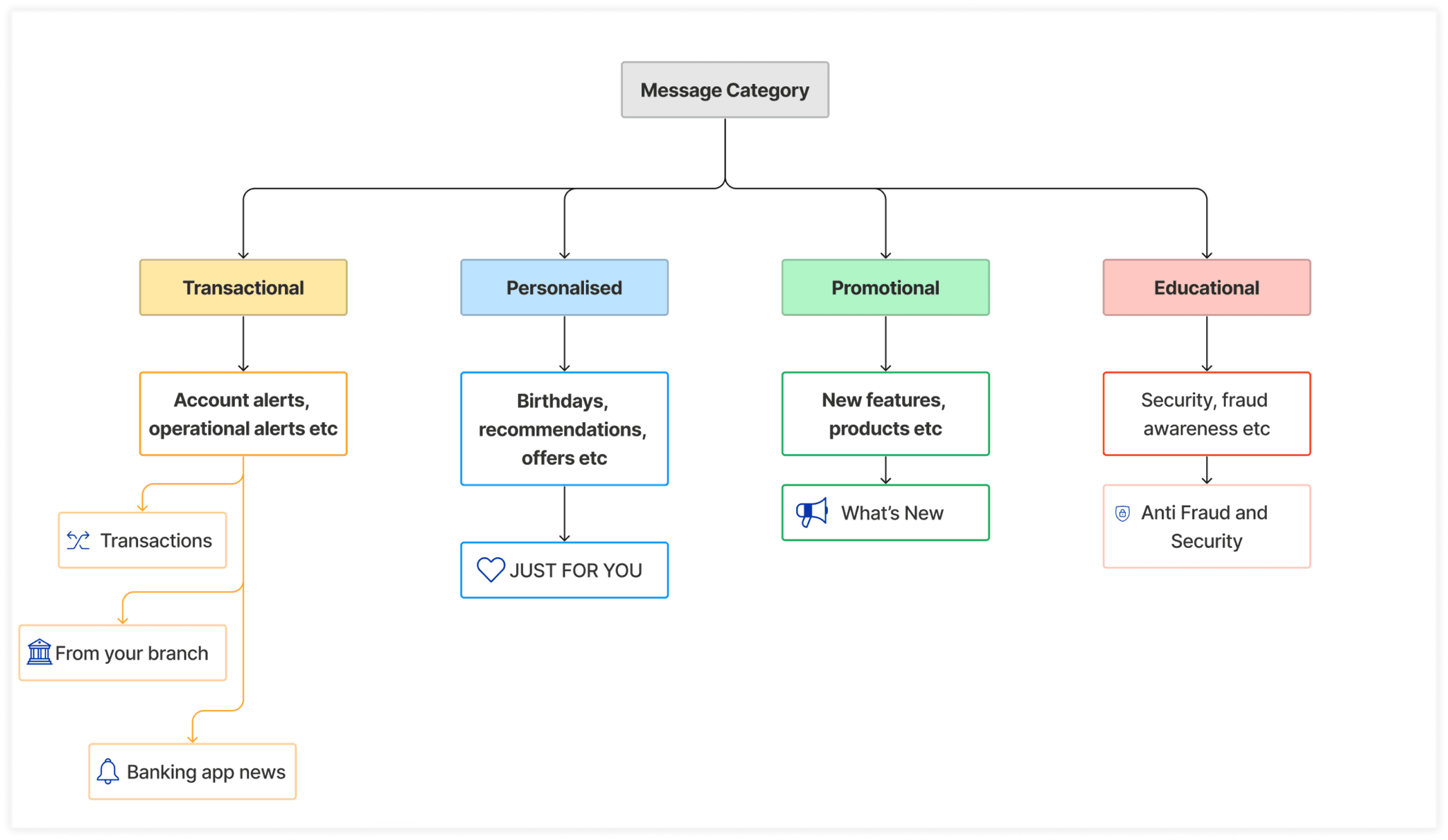

Integrating AI chatbot with live chat, defining message categories.

Collaborating with voice branch, AI teams, and marketing for design optimisation and targeted offers.

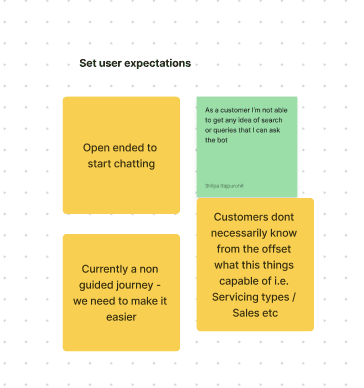

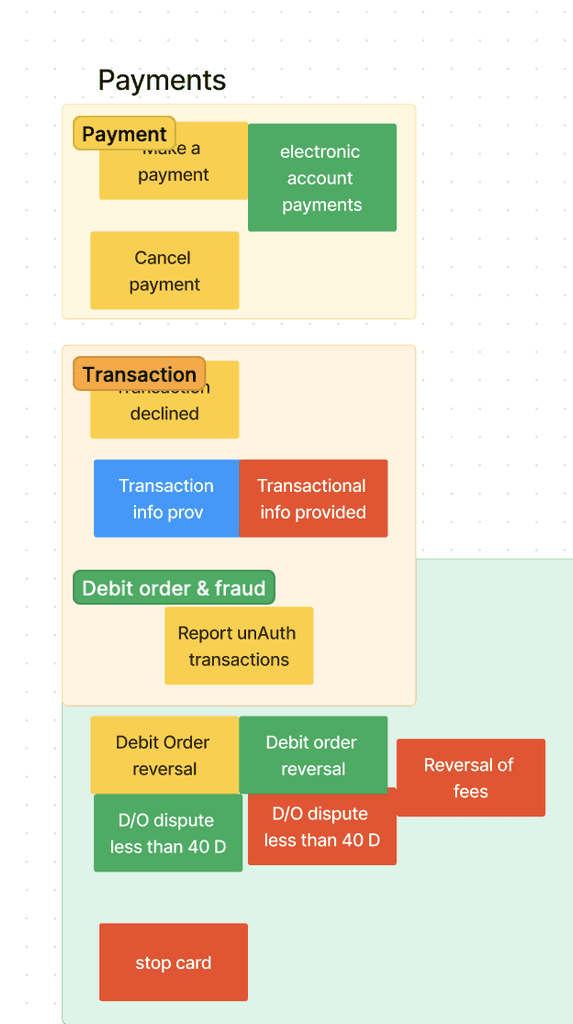

MAPPING THE FINDINGS

We organised and combined comms sent out to customers and could clearly see common themes emerging

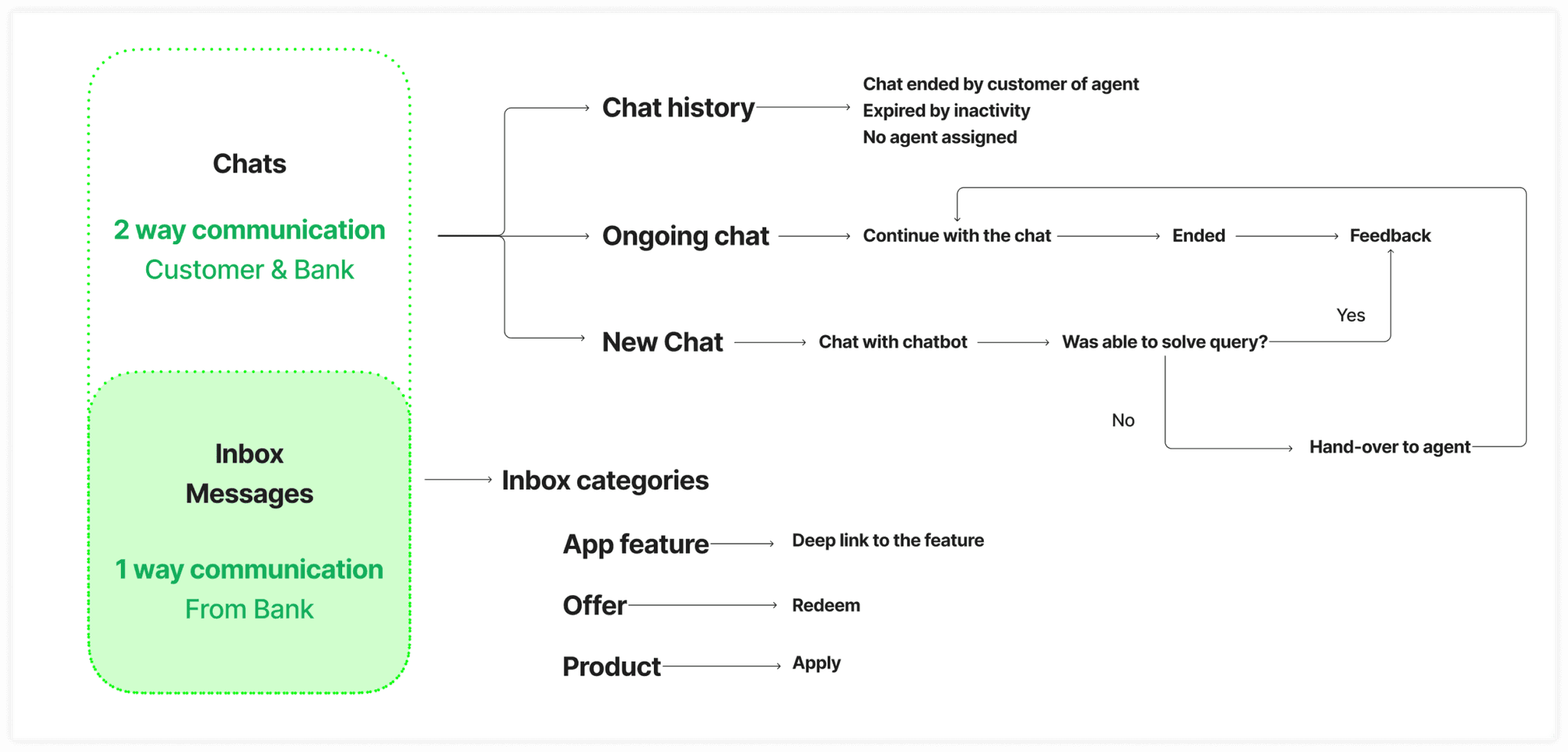

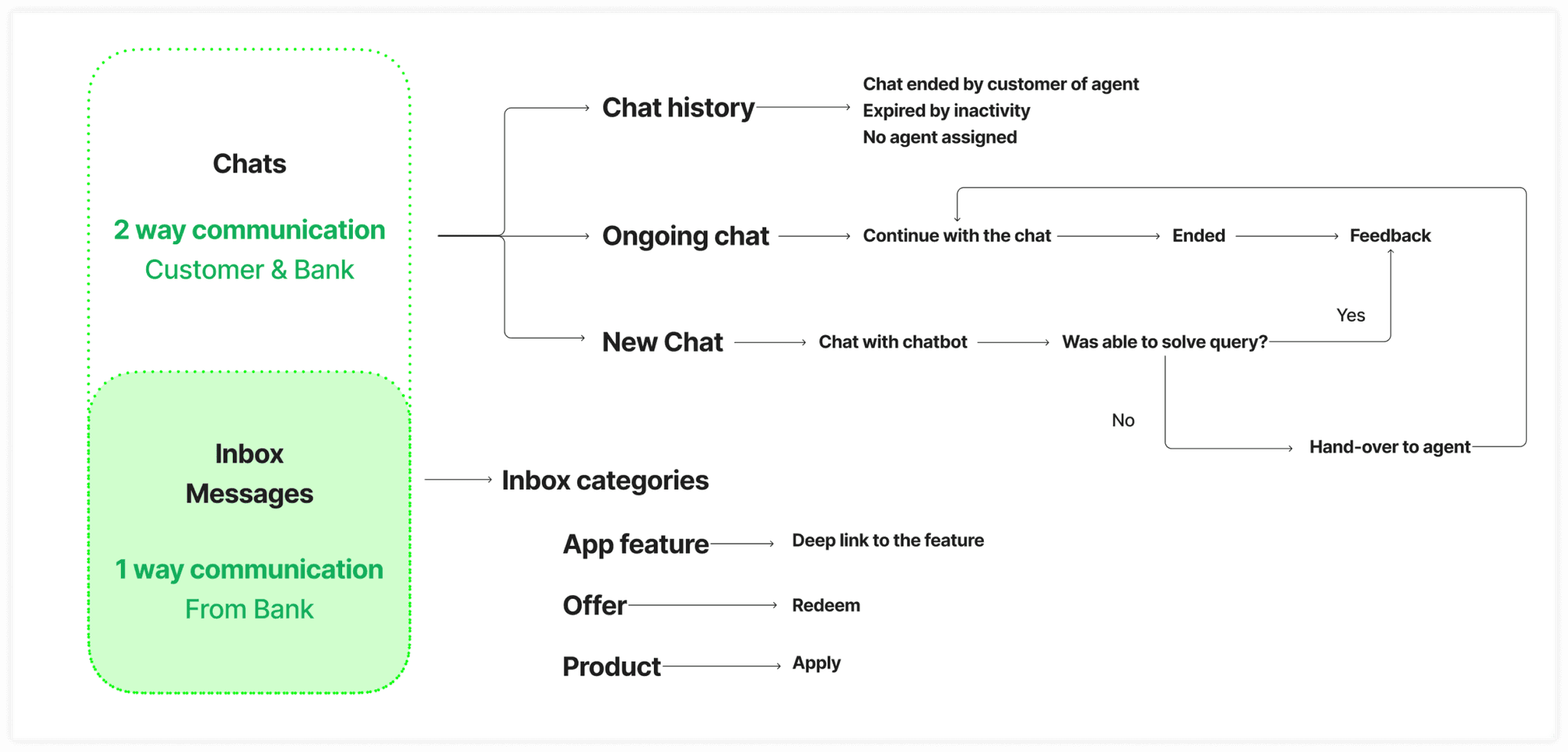

To cater to both one-way bank-to-customer and two-way chat communications, we split the screen into two distinct sections.

INBOX vs CHAT

EXECUTION

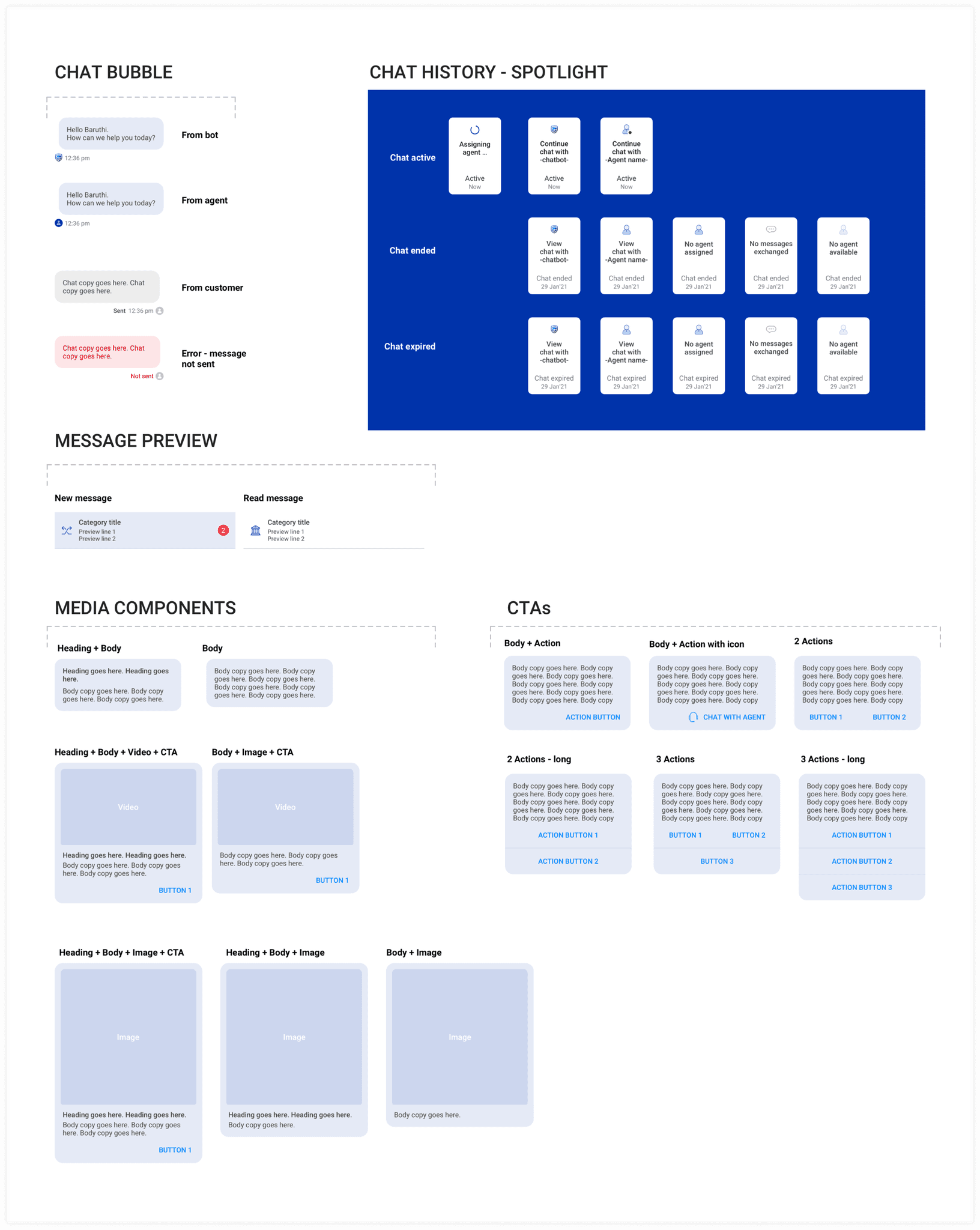

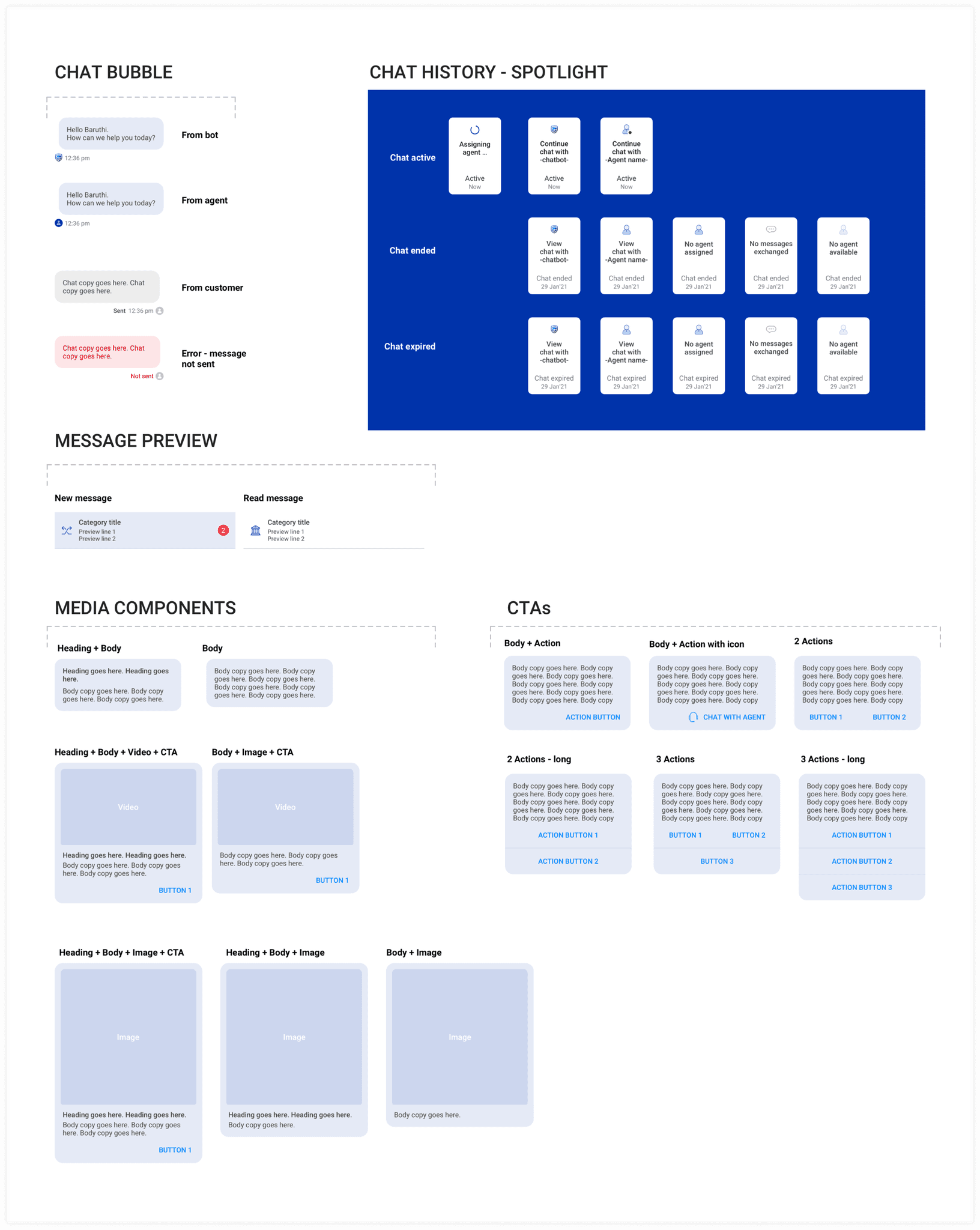

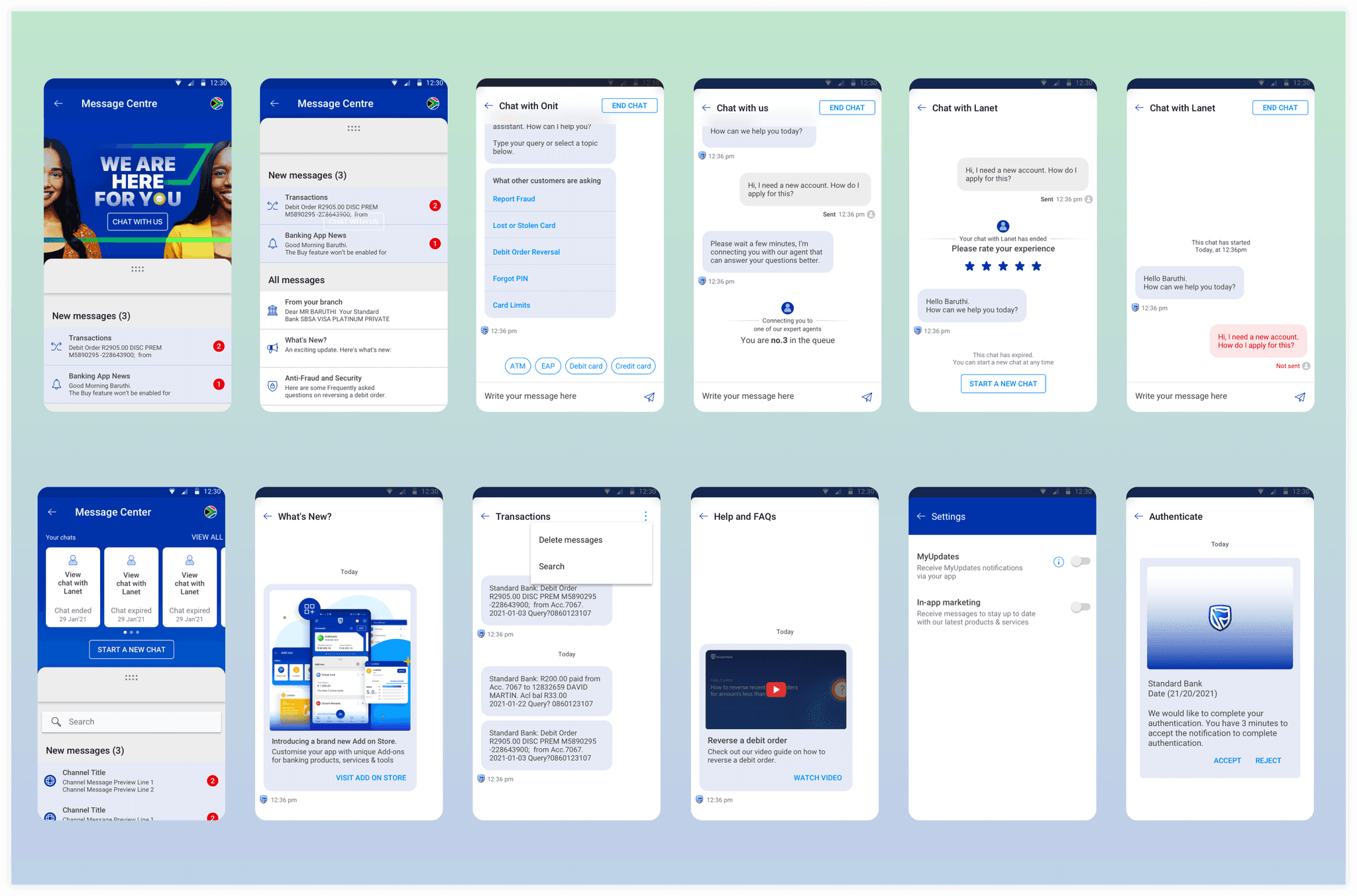

Designing for Versatility: Crafting Components for the Message Centre

Designing for Versatility: Crafting Components for the Message Centre

I designed various necessary components for the message centre, considering the inclusion of diverse media types like images, GIFs, videos, and text. I aimed for component reusability, ensuring that they were versatile enough for both Inbox and chat usage and could be integrated into a carousel.

STAKEHOLDER INTERVIEWS

To identify communication

types and top customer queries

Voice branch & marketing team

To understand business goals

Product owners

To recognise technical constraints

Tech leads, FE devs, BE devs, Feature analysts

To align with

broader design system

Design system team, other design teams

Many workshops with Voice Branch team & feature analysts helped us identify chatbot intents and journeys, starting with chatbot welcome message, till end of the chat

Workshops & EVEN MORE WORKSHOPS

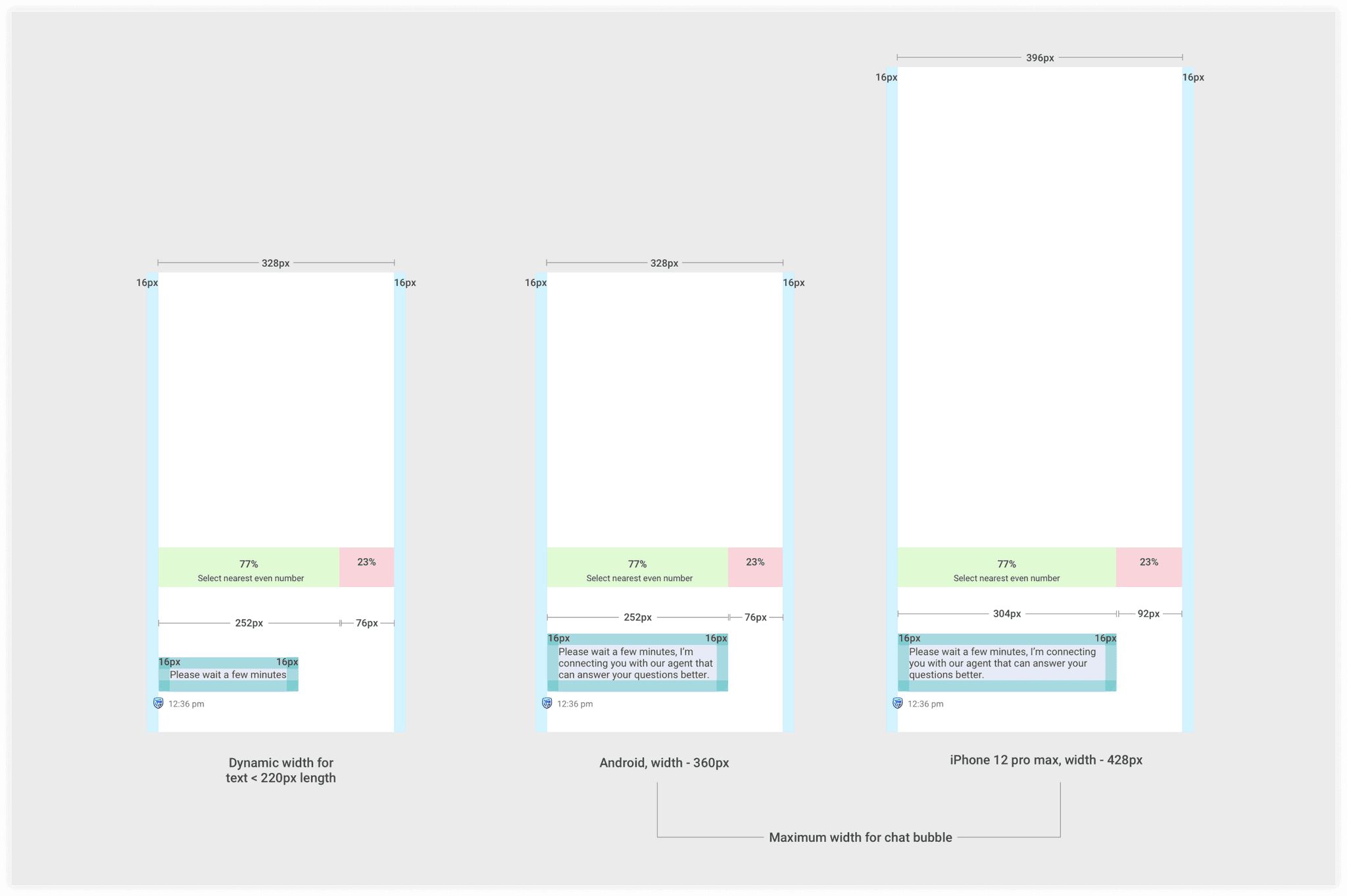

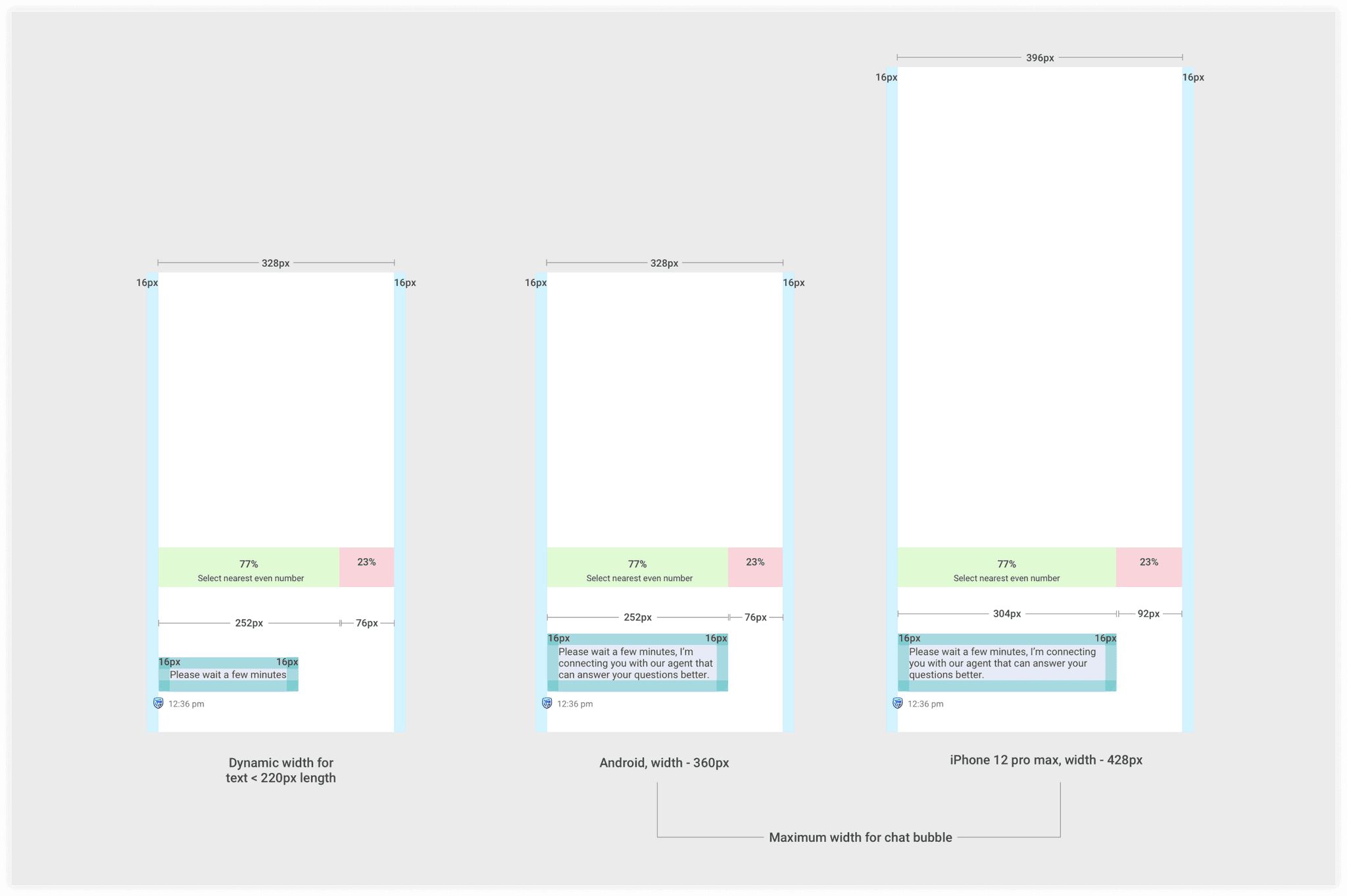

Don't let that bubble burst!

Don't let that bubble burst!

The challenge while creating chat bubble was how to ensure a comfortable viewing experience in both chat and inbox modes without cluttering with content or creating too much white space. My solution for an optimal chat interface involved setting the chat bubble's width at 77% of the screen.

PUTTING IT ALL TOGETHER

I developed over 50+ templates tailored to various scenarios, encompassing Inbox communications, error screens, interactions with bots and agents, and diverse applications of components in these conversational flows, such as account carousels, lists, quick replies, and chat attachments.

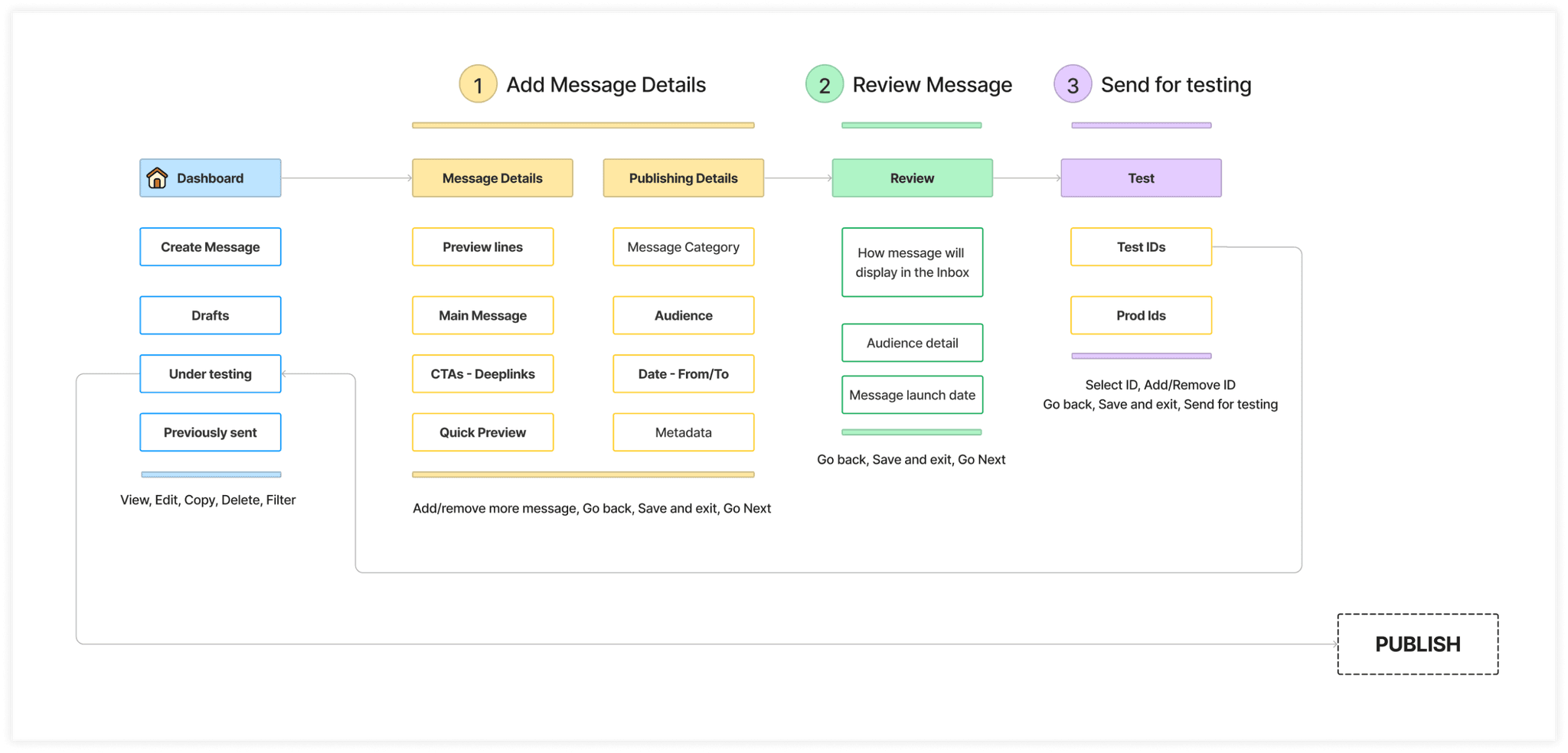

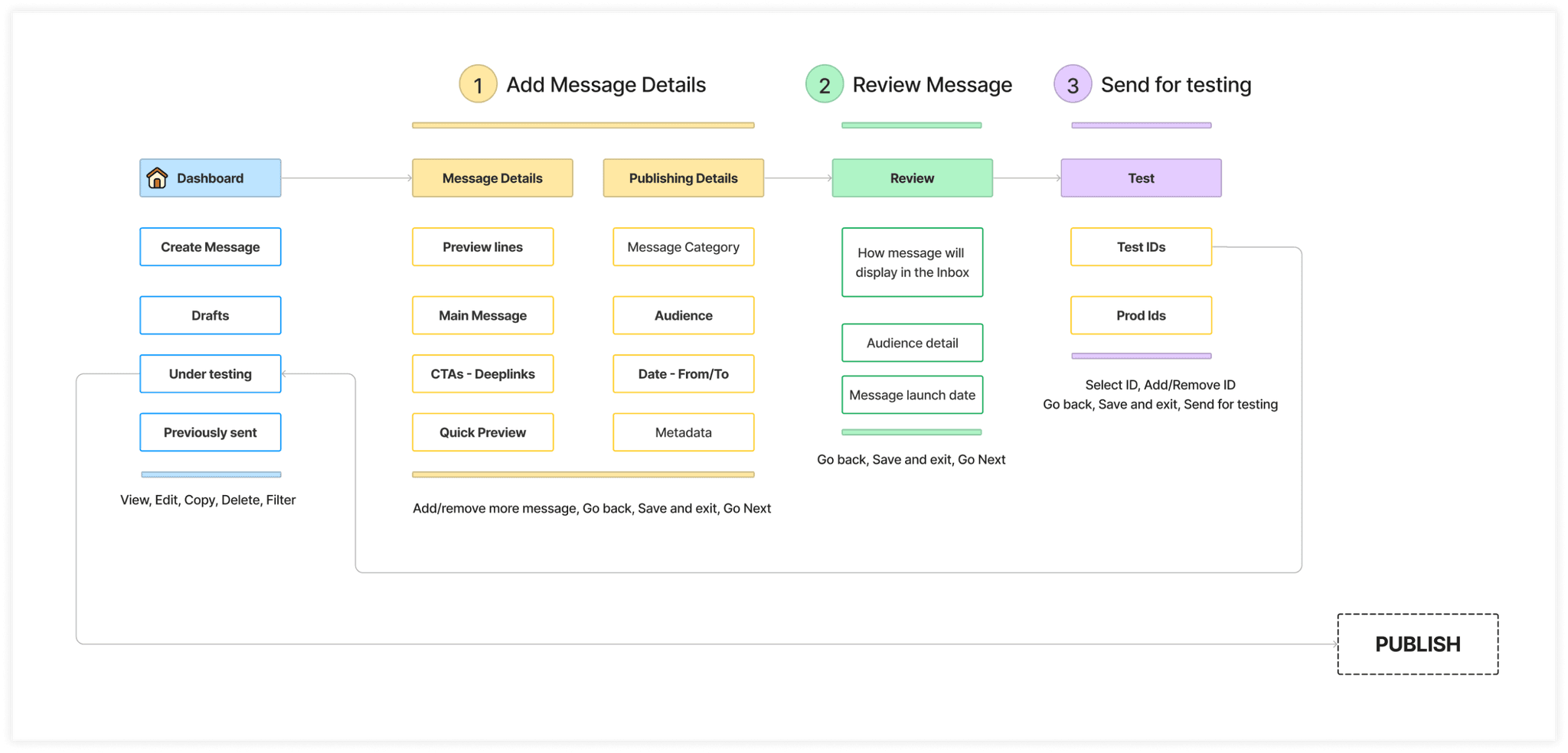

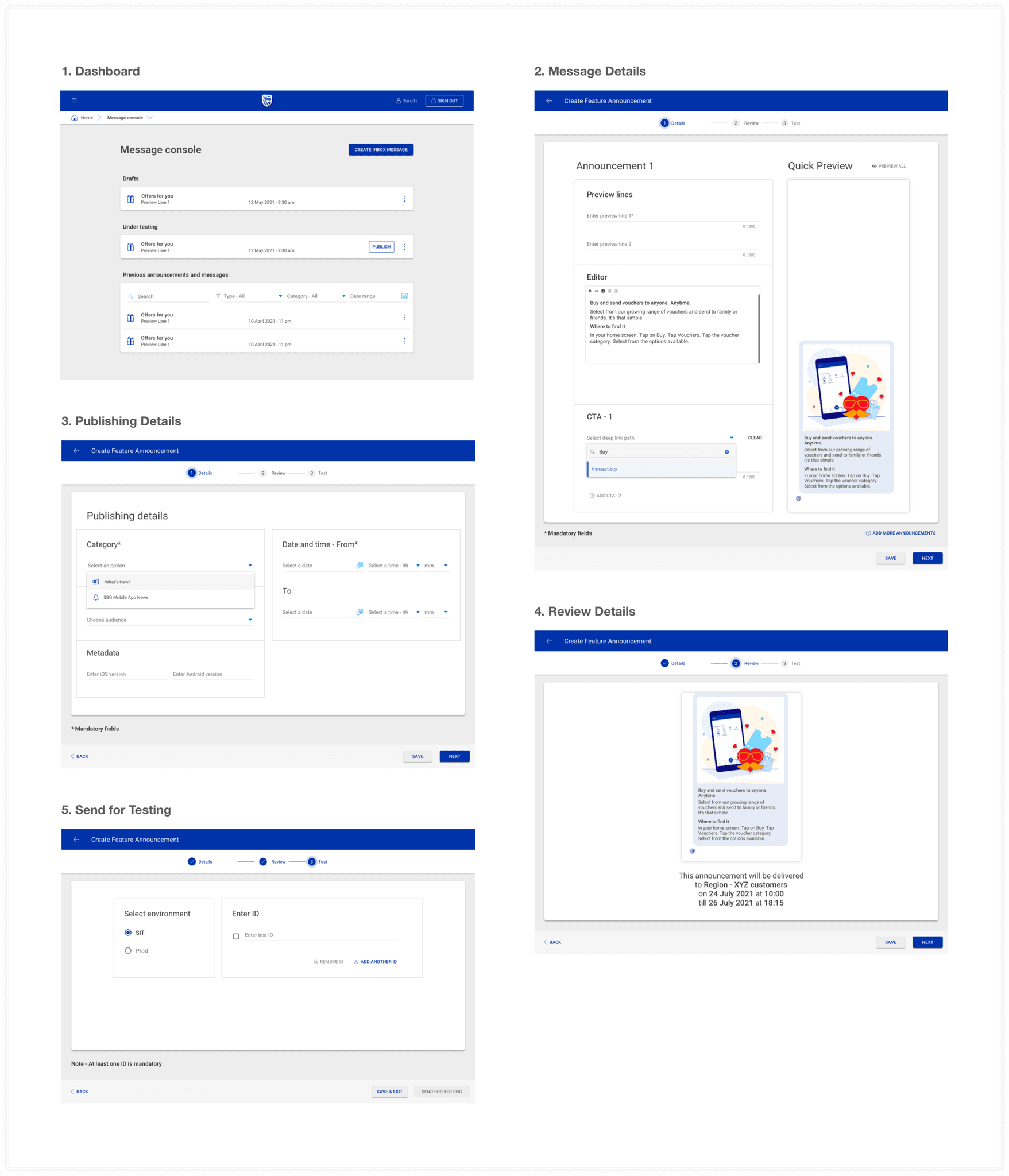

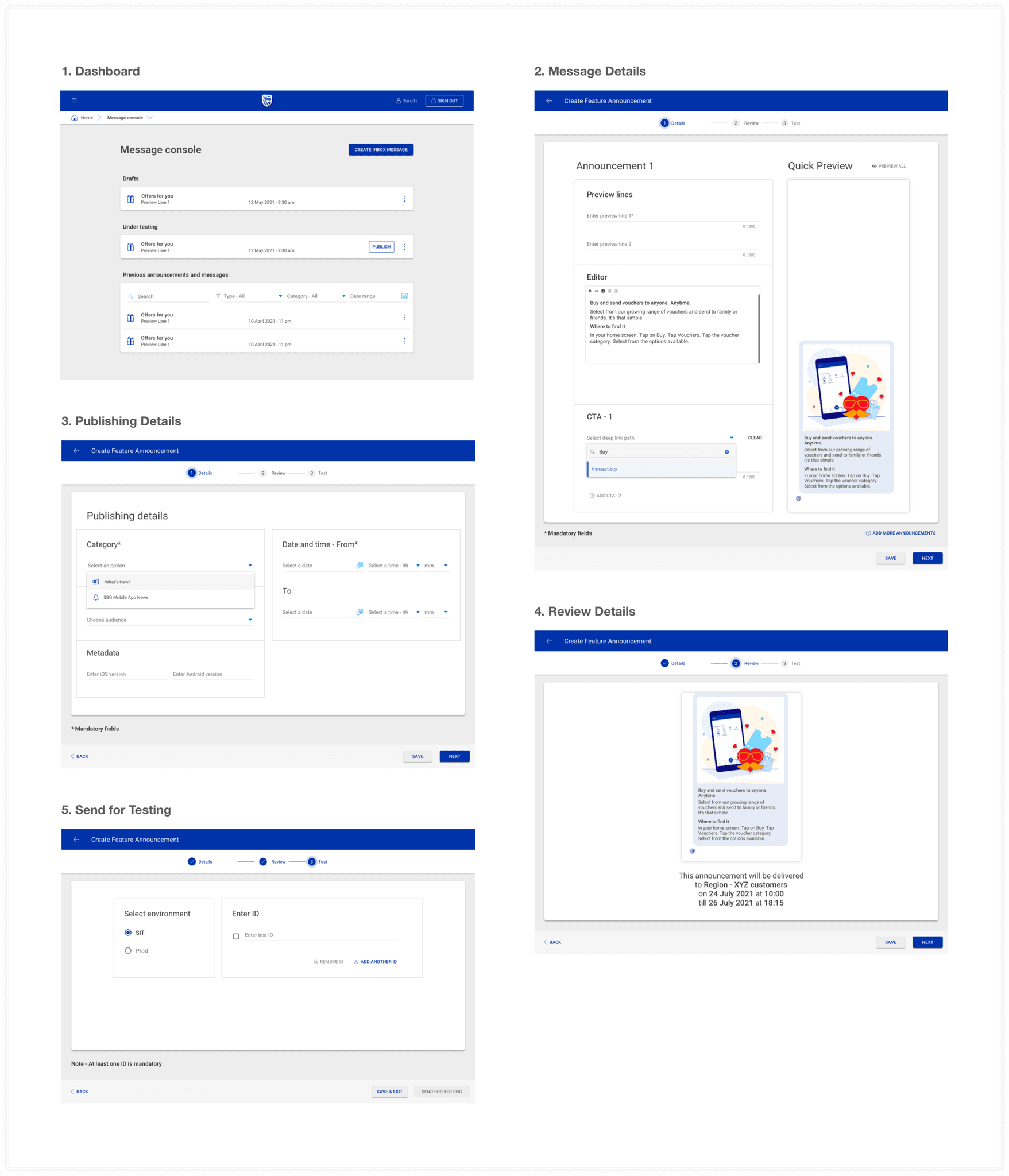

Intuitive Staff Console for Diverse Bank Teams to Reach Customers

I also designed a staff console for dispatching inbox messages to customers, tailored for use by various teams across the bank, including internal feature teams, marketing, fraud prevention, and personalisation groups. The design brief emphasised a simple and intuitive interface, with a development goal set to be achieved within a span of one to two months.

IMPACT

The data we collected provided clear evidence of the Message Centre's success, with a substantial number of customers visiting it

Reduced

Messaging Costs by

20%

Number

of Unique Vistors

3.6 M

Redemption

rate for campaigns

50%

8+ million page views

30k+ daily visitors

& a successful campaign with a food chain that boosted their new customers by 62% in just 3 months

~ The project is ongoing, my non-disclosure agreement obliges me not to share any additional information.

MY LEARNINGS

My major learning from the project was enhancing my collaboration skills across diverse teams, involving routine check-ins with stakeholders for early feedback, desk-checks with developers for technical alignment, assisting feature analysts, copywriters and the Voice branch in improving chatbot responses, coordinating with the marketing team for external communications, and regular reviews with the design system team.

Contact me at

Message Centre

Integrating Inbox and AI Chat functionalities for seamless and secure communication experience

COMING SOON